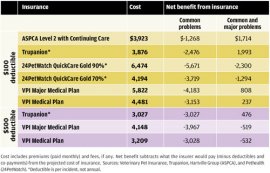

Pet insurance generally cost more than it paid out in our latest comparison of policies. (See .) Only in uncommon cases, when a pet required very expensive care, would the coverage have more than paid for itself.

Pet insurance generally cost more than it paid out in our latest comparison of policies. (See .) Only in uncommon cases, when a pet required very expensive care, would the coverage have more than paid for itself.

We compared three brands—ASPCA Pet Health Insurance, 24PetWatch QuickCare, and VPI—whose parent companies together control an estimated 90 percent of the market—and Trupanion, a relative newcomer. For our test, we used the lifetime vet bills of Roxy, a 10-year-old beagle in Dobbs Ferry, N.Y. She has been basically healthy but has had a few costly episodes, including three visits to a veterinary emergency room, two dental cleanings under anesthesia, and her share of ear and eye infections and gastrointestinal distress.

We adjusted Roxy's total bills into present-day dollars. Then we asked the insurers how much of Roxy's bills their policies would cover and how much they would charge in current dollars to insure her from puppyhood to age 10. None of the nine policies we compared would have paid out more than the projected premiums.

The picture changed somewhat when we added a series of hypothetical, potentially costly elements to Roxy's medical history: chronic arthritis, incontinence as a result of spaying, hypothyroidism, the removal of a benign tumor, and euthanasia. In that case, some policies returned a positive payout.

Pet insurance also paid off when we analyzed the cases of two real-life cats with serious and costly health problems. One was a kitten whose heart surgery and follow-up care cost more than $7, 100. The other was a 10-year-old cat with more than $9, 000 in cancer-treatment bills. In both cases we found that all nine of the policies would have saved the owner money.

We believe most pet owners will be better off passing up pet insurance and instead putting some money in an emergency "kitty." If you do decide to buy it, here are some suggestions:

- Download and read the company's sample policy, including its terms and conditions. Watch for limitations, cost-sharing, and service fees. Most policies require deductibles, co-pays, or both. Look for coverage with simple, percentage-based payouts and no reliance on judgments of what's "reasonable."

- Watch for what's excluded. No pet insurance covers pre-existing conditions. Carriers often exclude hip dysplasia, a chronic malady. QuickCare Gold won't cover any illness claims for Chinese shar-peis or their crossbreeds, though it will cover accidents. VPI has its own long list of excluded conditions. Some insurers will exclude a newly diagnosed ailment when the policy is renewed or charge you more to avoid such exclusions. An insurer also might impose a maximum limit on treatment for individual illnesses, or on the yearly or lifetime reimbursement.

- Avoid riders for wellness care, which we found are generally not worth the price.

- If you plan to use the insurance for catastrophic coverage—say, $1, 000 and up—go for the highest deductible you can comfortably afford.

- Don't be caught off guard by premium increases, which can vary by state. Insurers may base their hikes on a pet's age, veterinary cost inflation, or other factors. Trupanion, the company that performed best overall in our New York example here and in our test with the two cats, recently raised its premiums an average of 52 percent in parts of California. The company, which projects payouts of 69 cents of every dollar collected, says it adjusts premiums according to veterinary inflation and the scope of available treatments.

We projected the net benefit of pet insurance under nine policies for Roxy, a healthy 10-year-old beagle. Over the years, her vet bills have totaled $7, 026 (in current dollars). Because Roxy has had few major health problems, the insurance would have cost more than it paid out. But when we added treatment for more serious problems and increased her vet bills to $12, 685, five of the nine policies would have paid back at least a little more than they cost.

YOU MIGHT ALSO LIKE